What Is Bookkeeping? Everything You Need To Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Maintaining a record of payments to your employees, including any perks, is critical for cost analysis. This document contains a list of all the liabilities that your company owes but has yet to pay. These schedules outline the revenues received in advance but not yet recognized as income.

Any grants or supplementary funds must be accounted for in your closing accounts. They include the most recent valuation of your real estate, equipment, or other big assets. Schedule a free consultation with our team to get an individualized quote at the best price for your business.

Internal management reports

As a result, the opening equity is the original investment made in the company. This could be the initiator’s own money, loans, or outside investments. Xenett collaborates with you to deliver robust automated accounting systems that provide rapid visibility into your finances and insights for bookkeeping clean up future growth… By auditing your receivables, you can ensure that all unpaid bills are appropriately recorded and that you follow up with clients/customers who still need to pay. Before you know it, it’s been months or even (yikes) years, since your bookkeeping has been properly updated.

If this describes you and you find yourself in need of a bookkeeping cleanup but no resources to do it, let us know. We look forward to helping you gain financial clarity and control. They’ll need lists of outstanding debt, loan and credit agreements, tax return filings, and other financial documents. Providing timely, accurate responses will limit the cleanup timeframe, help you avoid tax penalties and improve your long-term results. Automation both reduces your team’s workload and prevents future issues from occurring.

Access to detailed records of all transactions

Start by reaching out to other business owners for recommendations, searching online for providers and checking out reviews on Google or Yelp. If you don’t feel comfortable with a freelancer, there are many firms that offer bookkeeping services as well. If you find that you have a talent for and enjoy the process, you may consider starting your own bookkeeping business providing this service to others.

Submit your information here If you would like help evaluating your catch-up bookkeeping needs . Or Learn More About The Bookkeeping catch-up experts in our team. Common bookkeeping errors that can impact your taxes include incorrect expense categorization, unrecorded transactions, unreconciled accounts, and inaccurate revenue recognition. When a business’s accounting records fall out of order, its books no longer provide the guidance they were meant to. Nor do they provide compelling support for the business’s tax return filings in case of an audit. Sloppy or incomplete books may even prevent a business from qualifying for the loans, lines of credit, and investor funding on which its future growth rests.

Business stage

Getting ready to do bookkeeping cleanup sounds intimidating, but can be done effectively by systematically working through these steps to gather the information you need. Once you’ve cleaned your bookkeeping, your business will be better prepared for growth, tax season, and investment opportunities. While any competent employee can handle bookkeeping, accounting is typically handled by a licensed professional.

- This step is crucial to getting accurate information for your financial reports.

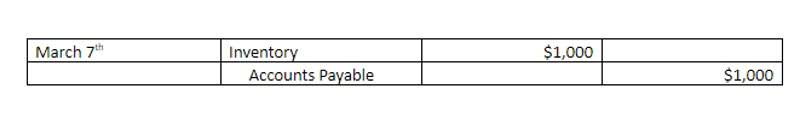

- When following this method of bookkeeping, the amounts of debits recorded must match the amounts of credits recorded.

- Since 2011, we’ve provided tax services, accounting, and controller services for companies and nonprofits with between $500K and $10M in revenue.

- Individuals who are successful bookkeeping professionals are highly organized, can balance ledgers accurately, have an eye for detail and are excellent communicators.

- By setting goals and acknowledging known issues with your bookkeeping practices, you’ll be able to determine an appropriate course of action going forward.